Malta Car Insurance Calculator

Buying car insurance in Malta can be overwhelming, especially when you don’t know how much you will pay. Many people only realise the true cost when the renewal date arrives, which can create stress and budget problems.

This is where a simple estimation tool becomes useful. Instead of guessing or relying on outdated prices, a reliable calculator helps you plan ahead with confidence. It provides a quick estimate based on your car and driver details, helping you make smarter decisions without wasting time.

Malta Car Insurance Calculator

A Malta Car Insurance Calculator is an online tool designed to help drivers estimate their annual premium. It uses basic information such as vehicle make and model, driver age, engine size, and claims history to generate an estimated cost. While it does not replace a formal quote from an insurer, it gives a clear idea of what you might pay and helps you compare different options before contacting providers.

What Is Car Insurance and How It Works in Malta?

Car insurance in Malta is a legal requirement that protects you, other drivers, and your vehicle from financial loss in case of accidents or damage. The cost depends on factors such as your car’s value, engine size, your driving history, age, and the level of coverage chosen.

A comprehensive policy covers more risks, while third-party insurance is usually cheaper but offers limited protection. Understanding these factors helps you choose the right policy and avoid surprises at renewal.

How Much Will I Pay for Car Insurance in Malta?

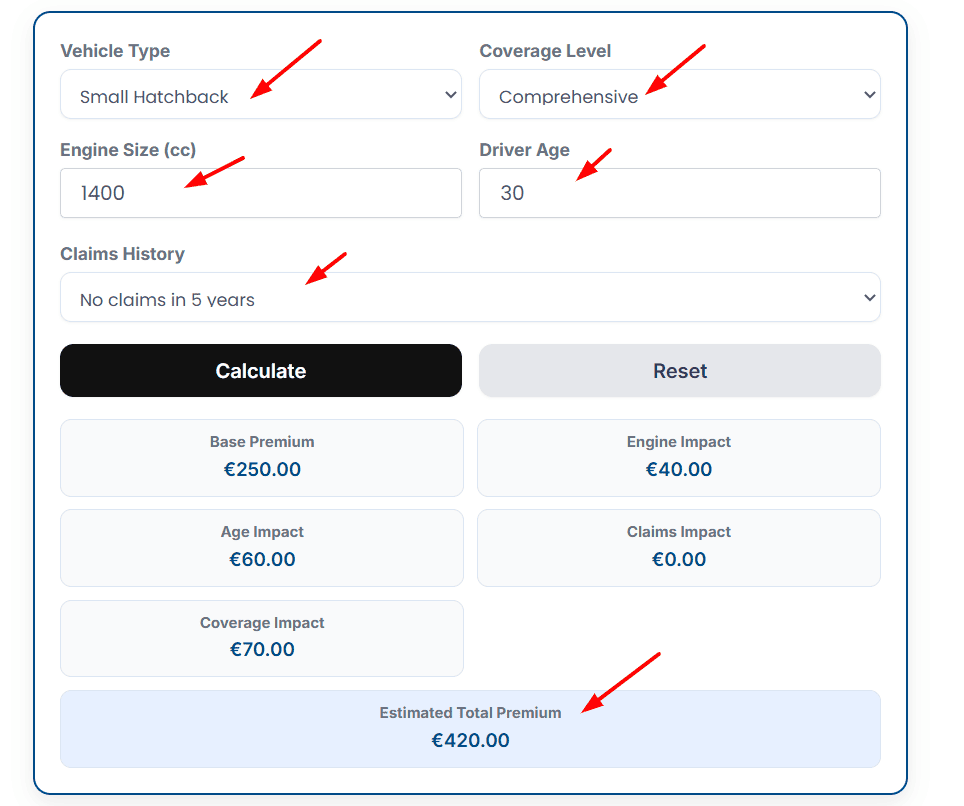

Use this calculator to get an instant estimated premium based on your car type, driver age, engine size, claims history, and coverage level.

Example: Small hatchback, driver age 30, no claims, 1400cc engine, comprehensive coverage → Estimated Annual Premium: €420

Step 1: Enter Vehicle Type and Model

Chosen: Small hatchback

Base Premium: €250

Step 2: Enter Engine Size

Input: 1400 cc

Engine Impact: €40

Step 3: Enter Driver Age

Input: 30 years

Age Impact: €60

Step 4: Enter Claims History

Input: No claims in 5 years

Claims Impact: €0

Step 5: Choose Coverage Level

Chosen: Comprehensive

Coverage Impact: €70

Step 6: Click on Calculate

Calculator outputs:

- Base Premium: €250

- Engine Impact: €40

- Age Impact: €60

- Claims Impact: €0

- Coverage Impact: €70

- Total Estimated Premium: €420

Notice: This estimate is for guidance only. Insurers may apply additional fees or discounts based on detailed risk assessment. Always verify final premium with the insurer. You can also check your vehicle road licence costs using a Malta car licence calculator for complete financial planning.

Common Scenarios and Planning Ahead

People often use estimation tools when buying a new car, renewing a policy, or adding a new driver. Knowing the estimated cost in advance helps you decide which car is affordable and what coverage suits your budget.

Planning ahead also helps households manage multiple vehicles without unexpected financial pressure. Similar to how people estimate repayments using a Loan Calculator Malta, insurance estimation supports smarter financial decisions.

Why Estimating Your Car Insurance Cost Matters?

Estimating your car insurance cost is about control and clarity. Without an estimate, drivers may underestimate yearly expenses and strain their monthly budget. With a clear idea of the premium, you can compare insurers realistically, plan renewals on time, and avoid penalties.

It also helps you choose the right coverage level based on your needs. Over time, these informed decisions can save money, reduce stress, and make car ownership in Malta more predictable and manageable.

Common Mistakes to Avoid

One common mistake is assuming all insurers charge the same premium. Another is relying on outdated information, which can lead to incorrect budgeting. Some drivers forget to include all vehicle drivers or ignore claims history, while others confuse insurance costs with car maintenance expenses. Using accurate inputs and updated tools helps avoid these issues.

Related Tools:

FAQs

Q:1- What factors affect car insurance premiums in Malta?

A:- Premiums depend on car value, engine size, driver age, claims history, and coverage level.

Q:2- Is an online calculator result final and official?

A:- No, it is an estimate only. Final premiums are confirmed by insurers after detailed assessment.

Q:3- Can young drivers get cheaper insurance in Malta?

A:- It is possible, but young drivers usually pay higher premiums due to higher risk. Discounts may apply for safe driving records.

Q:4- Does the car’s engine size affect the premium?

A:- Yes, larger engines often increase the premium because they are considered higher risk.

Q:5- Should I choose comprehensive or third-party insurance?

A:- Comprehensive offers more protection but costs more. Third-party is cheaper but covers limited risks.

Q:6- Where can I check official insurance rules in Malta?

A:- You can visit the Malta Financial Services Authority (MFSA) website for official insurance guidance.

Q:7- Is it useful to estimate costs before buying a used car?

A:- Yes, it helps you understand long-term ownership costs and avoid budget surprises.