Budget Malta Tax Calculator

Managing personal finances in Malta can feel overwhelming, especially when annual budget announcements introduce new tax rules and rate adjustments. Whether you’re a salaried employee, freelancer, or business owner, understanding how policy changes affect your take-home income is essential for smart planning.

That’s where tools like the Budget Malta Tax Calculator become helpful, turning complex tax updates into clear, usable numbers. Instead of guessing your liabilities or relying on rough estimates, a structured approach helps you stay compliant and confident.

In this guide, we’ll break down how budget-based tax calculations work in Malta, common scenarios where they matter most, and how you can avoid costly mistakes while planning ahead with clarity and confidence.

What is Budget Malta Tax Calculator ?

The Budget Malta Tax Calculator is an online estimation tool designed to reflect the latest fiscal measures announced in Malta’s national budget. It applies updated tax rates, bands, and credits to your income details, helping you estimate payable tax and net salary.

Unlike generic tools, it considers budget-specific adjustments so users can see how new policies may impact them before the year progresses. Many people also compare results with tools like the malta tax calculator 2026 to cross-check projections and ensure accuracy while planning finances.

How Much Tax Will I Pay in Malta?

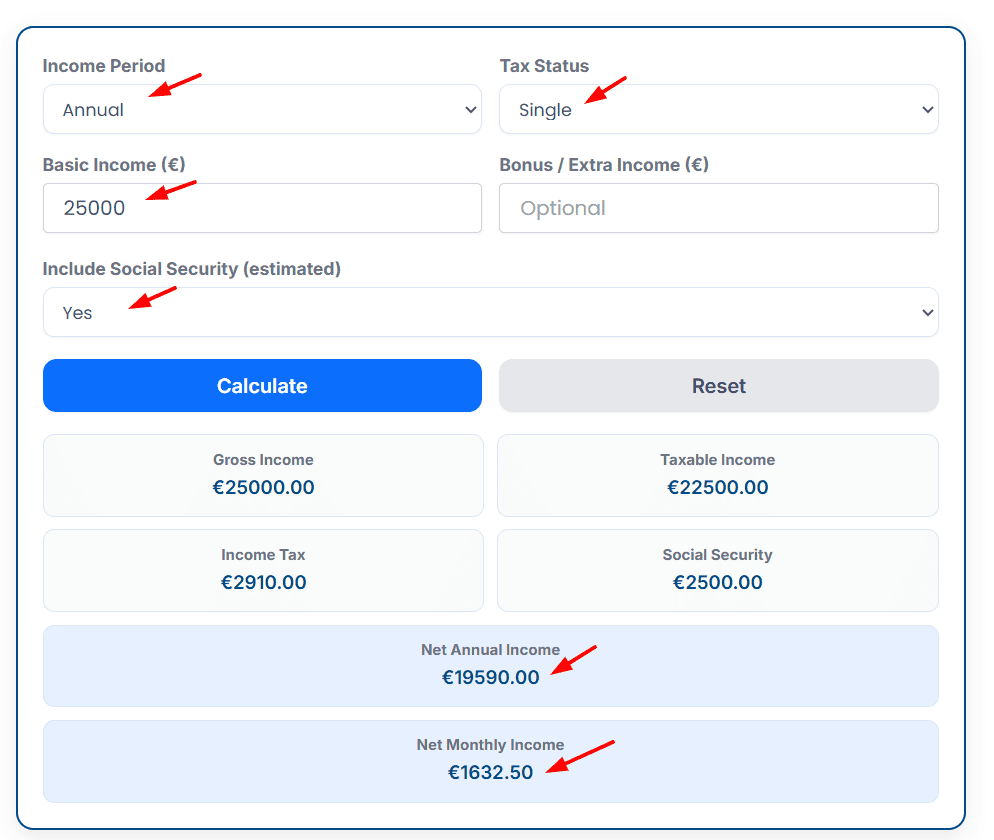

Use this calculator to get an instant estimated Malta income tax and net salary based on your income, tax status, bonus income, and social security contribution.

Single person, annual income €25,000, no bonus, social security included → Estimated Net Annual Income: €19,590 (approx.)

Step 1: Select Income Period

Chosen: Annual

This means the entered income is calculated on a yearly basis.

Step 2: Select Tax Status

Chosen: Single

Tax bands and allowances are applied according to single-person rates.

Step 3: Enter Basic Income

Input: €25,000

This is your main annual salary before any deductions.

Step 4: Enter Bonus / Extra Income (Optional)

Input: €0

No additional income is added in this example.

Step 5: Include Social Security Contribution

Chosen: Yes

Estimated Social Security Contribution applied: €2,500 (approx. capped estimate)

Step 6: Click on Calculate

The calculator automatically computes tax and net income based on current budget assumptions.

Calculator Output (Result)

- Gross Income: €25,000

- Social Security Contribution: €2,500

- Taxable Income: €22,500

- Income Tax (after budget relief): €2,910

- Total Deductions: €5,410

✅ Net Annual Income: €19,590

✅ Net Monthly Income: €1,632.50

Notice: This calculator provides estimates only.

Common Scenarios and Planning Ahead

This type of calculator is especially useful during salary negotiations, job changes, or when planning investments. Employees can estimate how annual increments interact with malta budget tax changes, while self-employed individuals can plan advance payments.

Families budgeting for the year can also assess household cash flow by understanding expected deductions. When combined with resources from a malta calculator hub, users can build a complete financial picture and prepare early instead of reacting late.

Why Use a Budget-Based Tax Calculator ?

Using a budget-aligned tax calculator goes beyond simple number crunching. Malta’s tax system evolves annually, and even small changes in bands or credits can affect monthly income. A calculator tailored to the budget helps you understand real-world impact, not just theoretical rates.

It supports smarter decisions like adjusting savings, planning allowances, or restructuring income sources. For newcomers navigating taxes Malta for the first time, it offers clarity without needing advanced tax knowledge. Over time, this proactive approach reduces surprises, improves compliance, and builds financial confidence, making it a valuable planning companion rather than just a once-a-year tool.

Minor mistakes in inputs can lead to major tax miscalculations

Many users rely on outdated calculators that ignore recent budget updates. Others enter gross figures incorrectly or forget additional income sources, leading to inaccurate results. Skipping verification with a malta tax bracket calculator can also cause misinterpretation of rates. Lastly, treating estimates as final figures instead of planning guides often leads to budgeting errors.

FAQs

Q:1- What makes a budget-based tax calculator different from a regular one?

A:- A budget-based calculator reflects the latest fiscal announcements and applies updated tax bands and credits, while regular calculators may still use older rates and rules.

Q:2- Can I rely on these calculators for official tax filing?

A:- These calculators are mainly for estimation and financial planning. For official tax filing, it’s always better to confirm figures with the tax department or a qualified professional.

Q:3- Do budget tax changes affect all income levels equally?

A:- No, budget tax changes usually impact specific income brackets differently, which is why updated and budget-aligned tools are important for accurate estimates.

Q:4- How often should I recalculate my taxes?

A:- You should recalculate your taxes after every new budget announcement or whenever there is a major change in your income or employment status.

Q:5- Are allowances and credits included in estimates?

A:- Most modern calculators include standard allowances and tax credits, but users should always double-check the inputs to avoid missing details.

Q:6- Where can I learn more about Malta’s official tax rules?

A:- You can check official government resources related to Malta’s taxation system. For detailed and updated information, visit the Commissioner for Revenue website.

Q:7- Can I compare results with other tools for accuracy?

A:- Yes, comparing results with other trusted tax calculators helps validate estimates and gives better confidence in your tax planning.