Loan Calculator Malta

Money decisions feel easier when numbers are clear from the start. Before committing to any loan, most people simply want to know one thing: “Can I afford this comfortably?” This article is designed to answer that question in a simple, practical way.

Instead of confusing formulas or banking jargon, you will learn how loan calculations work, why they matter, and how they support smarter choices. Whether you are planning a personal expense or thinking long-term,

understanding repayments early can remove stress and build confidence. With the right approach, loan planning becomes less about risk and more about control.

What Is a Loan Calculator ?

A loan calculator is a digital tool that helps you estimate repayments before applying for a loan. You enter basic details such as loan amount, interest rate, and tenure, and the tool calculates what you may need to pay over time.

Many calculators provide a simple and intuitive interface, allowing you to test different scenarios and plan an affordable repayment plan. By seeing results instantly, users can better understand monthly payments, total interest, and overall repayment,

supporting smarter financial decisions for first-time borrowers, homeowners, and business owners alike.

How Does the Loan Calculator Calculate Your Repayment ?

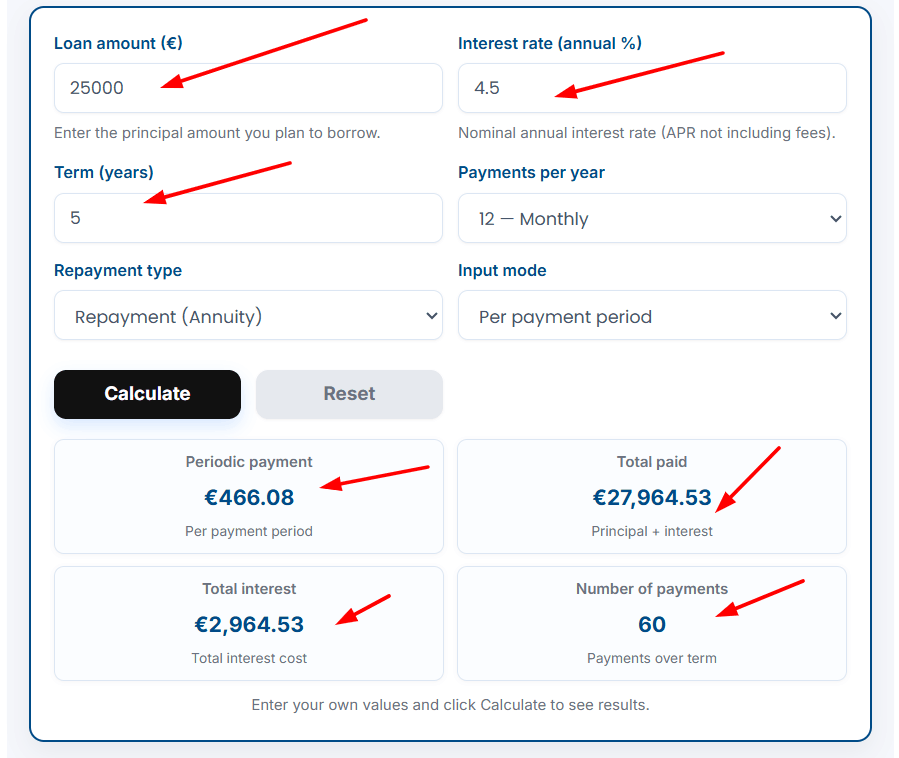

Suppose:I want to take a €25,000 loan at 4.5% annual interest for 5 years with monthly payments. How does the calculator calculate the result?

Step 1: Enter the loan details

You enter the following values in the calculator:

Loan amount = €25,000

Interest rate = 4.5% per year

Loan term = 5 years

Payments per year = 12 (monthly)

Step 2: Convert annual interest into monthly interest

Because payments are monthly, the annual interest rate is divided by 12.

Monthly interest rate

= 4.5% ÷ 12

= 0.375% per month

Step 3: Calculate the total number of payments

The calculator calculates how many instalments you will make.

Total payments

= 5 years × 12 months

= 60 payments

Step 4: Apply the repayment formula

The calculator uses a standard annuity formula where each monthly payment includes both principal and interest.

At the beginning of the loan, a higher portion of the payment goes toward interest.

Step 5: Display the final results

Based on the entered values, the calculator shows:

Monthly payment: ≈ €466.08

Total amount paid over 5 years: ≈ €27,964.80

Total interest paid: ≈ €2,964.80

Total number of payments: 60

Notice: The calculation results shown in this example are for informational purposes only.

Common Scenarios and Planning Ahead

Different borrowers face different financial situations. For first-time borrowers, a loan calculator helps visualize monthly payments and total repayment, making it easier to plan a budget and avoid over-borrowing.

Homeowners can compare loans for home improvements or mortgages, considering interest rates and tenure to choose the most cost-effective option. Business owners can assess financing needs for expansion or equipment,

seeing how the cost of borrowing impacts cash flow. By exploring different scenarios in a user-friendly interface, everyone can make informed financial decisions and plan repayments in a way that fits their lifestyle and goals.

Why Using a Loan Calculator Matters ?

Using a loan calculator is about more than numbers; it is about confidence and control. By exploring different scenarios, users can make smarter decisions regarding the cost of borrowing.

The calculator helps people compare multiple loan options calmly instead of rushing into commitments. Seeing future repayments clearly allows users to align loans with their income and long-term plans.

This approach reduces guesswork, supports financial planning, and highlights the real cost of borrowing over time. Ultimately, it encourages responsible borrowing and long-term stability for both personal and business loans.

Common Mistakes to Avoid

Many users enter unrealistic interest rates, ignore fees, or select loan durations that strain monthly budgets. Others rely entirely on estimates without confirming lender terms. Always double-check inputs and treat results as guidance, not final approval.

Using a user-friendly experience and a reliable calculator helps avoid these pitfalls.

Releted Calculator-

FAQs

Q1: Is this calculator suitable for beginners?

A: Yes, it is beginner-friendly and easy to understand.

Q2: Can it help with budgeting?

A: Yes, it supports financial planning by showing realistic repayment estimates.

Q3: Does it show the full loan cost?

A: It displays both repayment amounts and total interest clearly.

Q4: Can businesses use loan calculators too?

A: Yes, they are useful for both personal and business planning.

Q5: Are results always exact?

A: Results are estimates and may vary based on lender terms and fees.

Q6: Should I rely only on calculator results?

A: No, always confirm final figures with your lender.

Q7: Where can I check official loan rules in Malta?

A: You can visit the MFSA website for official financial guidance and regulations.