Malta Car Registration Tax Calculator

Buying a car in Malta involves more than just choosing the right model; understanding the applicable taxes is crucial for smart financial planning. With fluctuating rates and varying charges based on engine size, age, and emissions, it’s easy to miscalculate expenses.

A Malta Car Registration Tax Calculator helps you estimate your registration costs accurately, giving peace of mind before signing any purchase agreements. Whether you are a first-time buyer, upgrading your vehicle, or managing a fleet for business, knowing these costs upfront makes budgeting easier, ensures compliance, and reduces surprises at the transport office.

What Is a Malta Car Registration Tax Calculator?

A vehicle registration tax calculator Malta is an online tool designed to estimate the registration tax on vehicles in Malta. It considers multiple factors including vehicle price, engine capacity, fuel type, and CO₂ emissions. Instead of relying on complicated tables or guesswork,

this calculator provides an instant estimate, helping users make informed decisions. It’s useful for private car owners, businesses, and anyone planning to register a new or used vehicle, streamlining the registration process and making costs transparent.

How to calculate registration tax ?

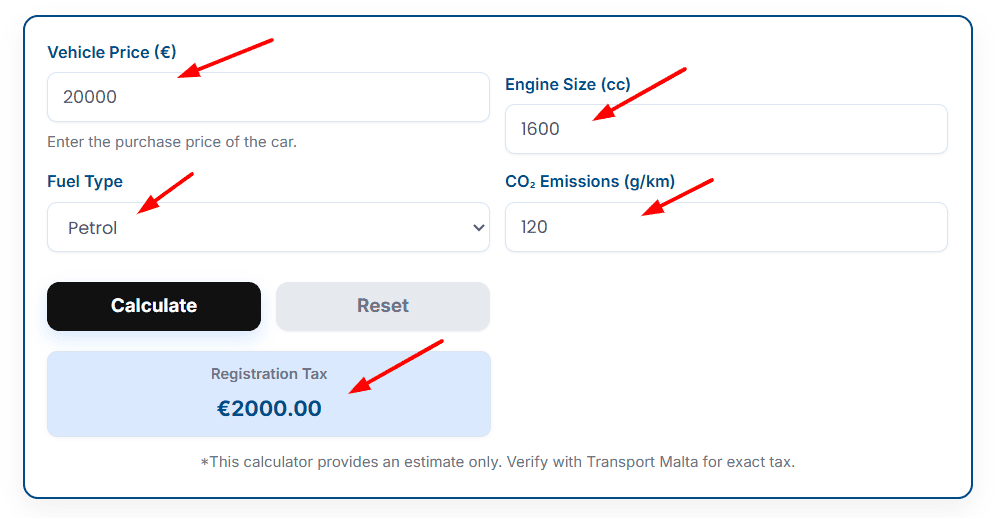

Example:- How much registration tax will I pay for a Petrol car in Malta costing €20,000, with 1600cc engine and 120 g/km CO₂ emissions?”

Step-by-Step Guide

- Enter Vehicle Price (€)

- Example:

€20,000 - This is what you paid or plan to pay for the car.

- Example:

- Enter Engine Size (cc)

- Example:

1600 - Smaller engines → lower tax; larger engines → higher tax.

- Example:

- Select Fuel Type

- Options: Petrol, Diesel, Hybrid, Electric

- Example:

Petrol - Diesel = slightly higher tax, Electric = often zero.

- Enter CO₂ Emissions (g/km)

- Example:

120 - Higher emissions → higher tax.

- Example:

- Click “Calculate”

- The estimated registration tax appears immediately.

- Example Result:

€2,000.00

- Click “Reset” (Optional)

- Clear all fields to enter a new car.

Example Table for Visual

| Field | Example Input |

|---|---|

| Vehicle Price (€) | 20,000 |

| Engine Size (cc) | 1600 |

| Fuel Type | Petrol |

| CO₂ Emissions (g/km) | 120 |

| Estimated Tax | €2,000.00 |

Notice: This is an estimate only. Verify final tax with Transport Malta.

Common Scenarios and Planning Ahead

For new car buyers, this calculator provides a clear estimate of registration taxes across various vehicles, making it easier to choose a model that matches your budget. Used car owners can compare options using the transport Malta registration calculator to understand which vehicle is more economical to register.

Businesses managing fleets can plan costs efficiently, factoring in car tax Malta for multiple vehicles. By exploring different scenarios, users can anticipate costs, plan finances better, and avoid unexpected surprises during registration, ensuring a smooth and stress-free process.

Why Using This Calculator Matters ?

Estimating car registration taxes before purchasing is vital to avoid unplanned expenses. The Malta Car Registration Tax Calculator helps buyers understand how factors like engine size, fuel type, and emissions affect the final cost. With this insight, users can compare multiple vehicles,

identify the most cost-effective option, and plan their budget more efficiently. Accurate estimates also reduce delays at the transport office, prevent errors in paperwork, and give buyers confidence when negotiating prices. Whether for personal or business vehicles, using a calculator ensures transparency, saves time, and encourages responsible financial planning.

Common Mistakes to Avoid

Users often enter incorrect engine sizes or forget to consider CO₂ emissions, leading to inaccurate tax estimates. Some overlook additional fees or deadlines, which may result in penalties. Always provide accurate vehicle details and verify estimates with official sources.

Avoid assuming all cars are taxed equally; engine capacity, vehicle age, and fuel type significantly impact charges. Using the Transport Malta website alongside the calculator ensures compliance and eliminates surprises.

More Calculator:-

FAQs

Q:1- How accurate is a Malta Car Registration Tax Calculator?

A:- The calculator provides reliable estimates, though final charges may vary depending on documentation, updates in tax rates, or additional fees.

Q:2- Can I use it for new and used cars?

A:- Yes, it works for both, giving a clear preview of expected registration taxes for any vehicle type.

Q:3- Do electric vehicles have different tax rates?

A:- Yes, electric and hybrid vehicles may enjoy reduced or zero registration tax depending on current incentives.

Q:4- Is this calculator useful for businesses?

A:- Absolutely. It helps companies estimate taxes for fleet registrations efficiently.

Q:5- Where can I verify the final registration tax?

A:- Check the Transport Malta official website to confirm exact amounts and regulations.

Q:6- Does engine size affect the registration tax?

A:- Yes, vehicles with larger engines generally incur higher taxes due to increased emissions.

Q:7- Can I plan my budget better with this calculator?

A:- Definitely. Knowing expected taxes helps plan the total cost, including insurance and maintenance, before purchasing.