Personal Loan Calculator Malta

Managing loans without clarity can quietly strain your monthly budget. Many borrowers focus only on approval, not on how repayments will impact daily life. This is where smart calculation becomes essential before signing any agreement.

A Personal Loan Calculator Malta helps borrowers understand affordability, future commitments, and realistic expectations in advance. Instead of guessing figures or relying on assumptions, users can plan with confidence and accuracy.

Whether you are preparing for a personal goal, handling emergencies, or organizing finances responsibly, using a digital calculation approach brings control and peace of mind.

With better insights into repayments and timelines, borrowers in Malta can make informed financial decisions without unnecessary stress or surprises later.

What is a Personal Loan Calculator Malta ?

A personal loan calculator is an online financial tool that helps borrowers estimate loan costs clearly and efficiently. Acting as a Malta loan calculator, it allows users to calculate monthly payments,

including monthly installments or monthly instalments, while also showing total repayment, total loan repayment, repayment amount, and the overall cost of loan.

Users simply enter the loan amount, provide an interest rate input, and choose a repayment period input. This calculator Malta solution supports personal loans Malta by addressing real personal finance needs and practical loan planning tools.

It delivers accurate results using updated market rates and current market rates Malta, while aligning with Malta financial regulations and standards guided by the Malta Financial Services Authority and MFSA.

How to Use the Personal Loan Calculator (Step-by-Step)

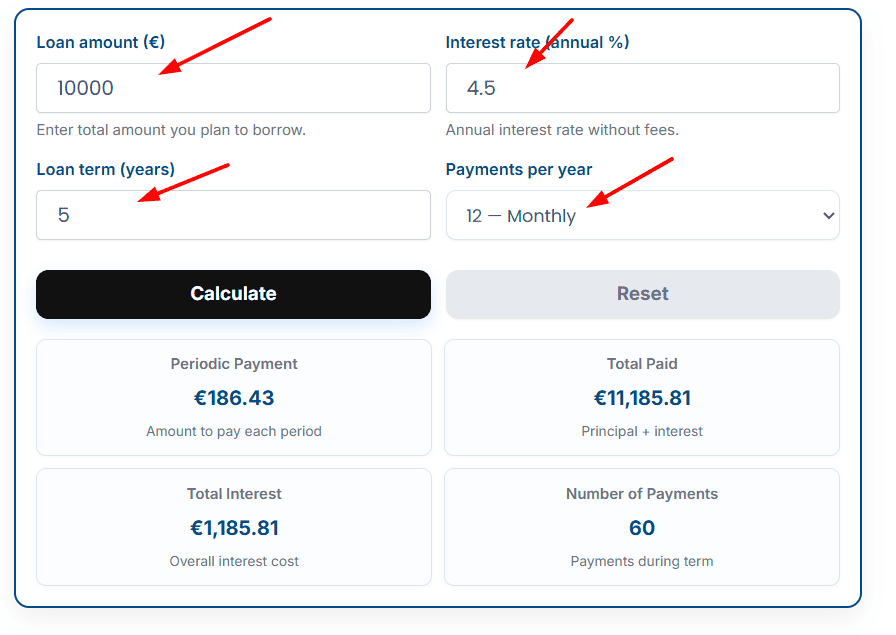

Example- How much will I pay every month if I take a €10,000 personal loan for 5 years at 4.5% interest ?

Step 1: Enter Loan Amount

Input: €10,000

Loan Amount Used: €10,000

Step 2: Enter Annual Interest Rate

Input: 4.5%

Annual Interest Rate Applied: 4.5%

Step 3: Select Loan Term

Input: 5 years

Loan Duration: 5 years

Step 4: Select Payment Frequency

Chosen: Monthly (12 payments per year)

Total Payments: 5 × 12 = 60 payments

Step 5: Click “Calculate”

Calculator outputs:

Periodic Payment: €186.43 per month

Total Amount Paid: €11,185.80

Total Interest Cost: €1,185.80

Number of Payments: 60

⚠️ Notice: This calculation is an estimate for guidance only. Actual loan repayments may vary depending on lender terms, processing fees, and final interest rate. Always confirm the final figures with your loan provider before committing.

How to Read and Interpret Your Loan Results ?

instead of manually working through formulas, the calculator instantly converts your inputs into clear financial insights. Once you enter the required details,

the system evaluates how interest impacts repayments over time and how the selected duration affects affordability. It breaks down figures in a simple format, showing how much you may need to pay each month and how costs change when terms are adjusted.

This approach allows borrowers to review outcomes side by side, understand repayment timelines, and plan finances confidently without technical knowledge.

By presenting results in a clear and structured way, the calculator supports informed decision-making while keeping the process fast, accurate, and easy to understand.

Common Scenarios and Planning Ahead

Many borrowers use this tool during loan comparison and financial comparison when choosing a suitable loan option or identifying the best loan option. An online loan calculator or free loan calculator supports realistic financial planning, offering practical budgeting help and budget management insights.

It helps assess borrowing limits, supports debt planning, and strengthens repayment planning. For long-term goals, it complements home loan planning and mortgage calculations,

especially when paired with a Home Loan Calculator, home loan calculator Malta, or mortgage calculator for structured mortgage planning and mortgage repayment clarity.

Why Use a Personal Finance Calculator Malta ?

Using a calculator before borrowing saves time, money, and stress. As part of a trusted calculators portal or financial calculator portal, this tool provides free to use access to reliable online financial tools that support long-term decision-making.

It simplifies financial planning tools, improves loan selection, and ensures loans align with real loan needs.

By clearly showing loan cost estimation, borrowers gain transparency before committing to personal loans. This reduces financial surprises and supports responsible borrowing across financial tools Malta.

Instead of relying on assumptions or sales pitches, users can confidently evaluate affordability and sustainability with facts in hand.

Common Mistakes to Avoid When Using Loan Calculators

One common mistake is ignoring future financial changes while reviewing numbers. Another error is selecting unrealistic tenures without assessing monthly impact. Many users also forget to compare interest variations or misunderstand repayment schedules.

Rushing decisions without reviewing total cost often leads to long-term stress. Using accurate inputs and reviewing results patiently ensures the calculator delivers meaningful guidance rather than misleading comfort.

Explore more Calculator:-

- ARMS Malta Bill Calculator

- Malta VAT Calculator

- Road Licence Calculator Malta

- Malta Car Registration Tax Calculator

- Notice Period Calculator Malta

FAQs

Q:1- What information is required to calculate a personal loan accurately?

A:- You need the loan amount, interest rate, and repayment duration to generate reliable repayment figures and cost estimates.

Q:2- Can loan calculators help compare multiple loan offers?

A:- Yes, they allow users to adjust rates and tenures to compare lenders effectively and identify affordable options.

Q:3- Are online loan calculators accurate for Malta residents?

A:- Calculators designed for Malta consider local financial conditions and provide realistic estimates when correct inputs are used.

Q:4- Is using a loan calculator free?

A:- Most calculators are completely free and accessible online without registration or personal data submission.

Q:5- Can a loan calculator help with budgeting?

A:- Yes, it helps users understand monthly commitments, making budgeting more structured and manageable.

Q:6- Where can I find official financial guidance in Malta?

A:- For regulatory information, you can refer to the official website of the Malta Financial Services Authority.

Q:7- Do loan calculators follow financial regulations?

A:- Reputable calculators align with general financial principles and regulatory guidelines used in Malta.